The Rise of Cryptocurrencies: Analyzing the Top 100 Global Assets

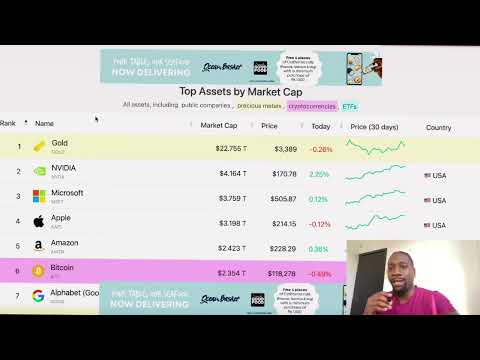

Crypto is becoming part of the new financial system—and those who understand it early will be the ones who thrive when the dust settles. he top 100 assets in the world… and you might be surprised: Cryptocurrencies like Bitcoin, Ethereum, XRP, and others are already competing with the biggest corporations, gold, and tech giants. And they’ve only been around for a little over a decade.

Harold Jones

9/7/20254 min read

Understanding Global Assets and Their Ranking

Global assets represent a broad spectrum of economic resources that hold intrinsic value, contributing to wealth creation and investment portfolios. These assets can be categorized into several types, with traditional forms including equities, bonds, commodities, and real estate. Among these, gold has historically been viewed as a safe haven investment, often sought after during times of economic uncertainty. Major corporations, through their stock valuations, also significantly influence asset rankings, representing a crucial component of the global financial system.

The introduction of cryptocurrencies, most notably Bitcoin, Ethereum, and XRP, has transformed the landscape of global assets significantly. These digital currencies have emerged as notable contenders, often competing in market capitalization with traditional assets. Unlike conventional forms of wealth, cryptocurrencies operate on decentralized networks, leveraging blockchain technology to facilitate secure transactions and ownership verification. This innovative framework fosters a unique financial ecosystem that is differentiating itself amid traditional market structures.

Asset rankings are primarily determined by market capitalization, which represents the total market value of an asset based on its current price multiplied by the total supply in circulation. As market conditions fluctuate, the valuations of both traditional and digital assets form a dynamic tapestry, influenced by economic indicators, investor sentiment, and technological advancements. The rise of cryptocurrencies has prompted a re-evaluation of how assets are ranked, revealing an increasing acceptance of digital currencies in the broader financial context.

The convergence of traditional assets and cryptocurrencies illustrates a significant shift in investor behavior, as individuals increasingly diversify their portfolios to incorporate both. This trend highlights the necessity for individuals and institutions to remain informed about the evolving nature of asset classifications, aiding in sound financial decision-making in a rapidly changing economic landscape.

The Explosive Growth of Cryptocurrencies

The past decade has witnessed an extraordinary escalation in the popularity and adoption of cryptocurrencies, transforming them into significant financial assets within the global market. Born from the underlying blockchain technology, digital currencies such as Bitcoin and Ethereum have gained unprecedented traction, appealing to both institutional investors and retail enthusiasts alike. This rapid growth can be largely attributed to various factors including technological advancements, increased accessibility, and a shift in investor sentiment towards alternative forms of investment.

Initially, cryptocurrencies were often criticized for their volatility and perceived lack of stability. However, a shift in perspective has occurred, particularly as traditional financial markets have experienced unpredictable fluctuations. Investors are increasingly recognizing the potential of digital currencies to retain value, serve as a hedge against inflation, and diversify investment portfolios. This growing acceptance is evidenced by several major financial institutions integrating cryptocurrencies into their services, thereby legitimizing this asset class in the eyes of the mainstream.

Furthermore, the advent of decentralized finance (DeFi) has played a pivotal role in driving cryptocurrency usage. DeFi platforms facilitate financial transactions without intermediaries, granting users greater control over their assets while introducing innovative financial products and services. Consequently, this sector has attracted substantial investment and attention, further cementing the position of cryptocurrencies in the global financial landscape.

Milestones in the cryptocurrency journey, such as Bitcoin's soaring price in 2017, the initial coin offering (ICO) boom, and the growing regulatory frameworks established worldwide, exemplify the industry’s evolution. These events have not only shaped public perception but have also showcased the intricacies of a rapidly developing market. As cryptocurrencies continue to mature, their evolving nature places them in fierce competition with traditional assets, leading to a re-evaluation of their role within global markets.

Shifting Wealth: The Transition to a New Financial System

As the financial landscape evolves, a noticeable shift in wealth is occurring from traditional assets to cryptocurrencies. This movement signifies a fundamental transition in how value is stored and transferred. The advent of blockchain technology, which underpins most cryptocurrencies, plays a crucial role in this transformation. Blockchain facilitates decentralized transactions, ensuring transparency and security that traditional financial systems often lack. Its appeal lies in the democratization of finance, enabling individuals to participate in asset ownership without the need for intermediaries like banks.

One of the most significant attributes of cryptocurrencies that attract investors is their potential for high returns. While volatility remains a concern, the possibility of substantial gains often draws individuals seeking alternative investment opportunities. Additionally, cryptocurrencies offer unique features such as portability and divisibility, which traditional assets may not provide. These factors contribute to an increasingly diversified portfolio for investors willing to embrace this new paradigm.

The societal changes fueling this transition are multifaceted. A growing distrust of financial institutions, coupled with the demand for more accessible and efficient financial services, has paved the way for cryptocurrencies to flourish. Moreover, the rise of fintech innovations has encouraged adoption, enabling seamless transactions and interactions within the cryptocurrency realm.

However, with these opportunities come inherent risks. The speculative nature of cryptocurrencies, regulatory uncertainties, and the potential for fraud are significant concerns for investors embarking on this journey. As wealth shifts to cryptocurrencies, understanding these dynamics is essential for navigating the evolving financial system. Acknowledging both the risks and advantages associated with investing in cryptocurrencies will ultimately empower investors to make informed decisions in this rapidly changing environment.

Seizing the Opportunity: The Urgency of Investment in Crypto

The cryptocurrency landscape is characterized by rapid evolution and volatility, presenting unique investment opportunities that are increasingly hard to overlook. With the introduction of new technologies and blockchain innovations, the digital currency space is expanding swiftly. Investing in cryptocurrencies has the potential for significant returns, but this potential may diminish if one hesitates to enter the market. Individuals who delay their investments risk missing out on advantageous positions within the rapidly diversifying portfolio of the top 100 global assets.

For prospective investors, understanding the urgency to act is vital. The cryptocurrency market has shown an inclination towards sudden price surges, often driven by market sentiment, regulatory news, and technological advancements. Consequently, being an early participant can yield substantial benefits. It is essential to monitor key metrics such as market capitalization, trading volumes, and technological developments within the sector. Keeping track of these variables can provide insights into market trends and help in making informed decisions.

New investors should consider adopting a strategic approach to capitalize effectively on this opportunity. Diversification across various cryptocurrencies can mitigate risks while enhancing the potential for gains. It is also advisable to stay informed through credible news sources, forums, and expert analysis to understand market dynamics and emerging trends. Utilizing analytics tools can further help track performance and make data-driven decisions. A proactive mindset will be crucial as the cryptocurrency space continues to mature and innovate.

In conclusion, as cryptocurrencies reshape the financial landscape, recognizing the urgency of timely investments becomes paramount. By staying engaged, informed, and strategic, individuals can position themselves advantageously in this burgeoning market. The opportunity to invest in cryptocurrencies not only promises potential financial growth but also plays a role in shaping the future of the global economy.

Guidance

🛡️ Build a Life Abroad with Clarity, Not Chaos.

Smart relocatin for families and retirees who want strategy — not sales pitches.

Disclaimer: We are not financial or legal advisors. All content is for educational and strategic consulting purposes only. Our role is to coach, guide, and equip you to make informed, sovereign decisions.

Support

journeywithus4u@gmail.com

© 2026. All rights reserved.